Why choose our funeral home?

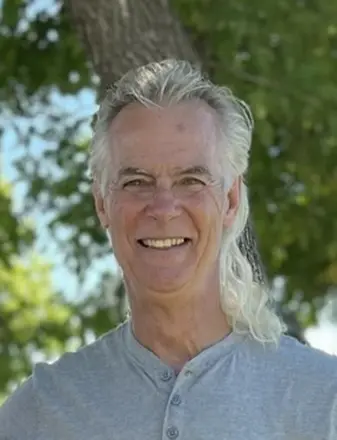

Bardal Funeral Home and Crematorium is dedicated to providing personalized, professional, and compassionate services to your family. Our goal is to lessen the burden on your family so that you can focus on celebrating your loved one's life and beginning your grief journey. Hear what other families have said about our services and get to know our experienced staff.